Want to Make Extra Money Now?

|

It's no secret that the use of a credit card can provide some convenience when you do not have cash on hand or wish to charge a purchase to a card.

In fact, credit card balances carried from month to month continue to inch up, reaching $420.22 billion in late 2018, according to NerdWallet’s annual analysis of U.S. household debt.

That’s an increase of about 5% over last year. The average U.S. household with credit card debt has an estimated $6,929 in revolving balances or balances carried from one month to the next, the analysis found. Even if you have found the best credit card for you, you still may not be using it right.

Is it really possible that people just do not understand how to use credit cards?

This is hardly a secret, but every day people still ask questions that imply they don't understand how to use their credit card effectively. Whether you have millennial debt or baby boomer debt, it's all the same. Here's how to pay it off.

How to Pay Off Debt: 4 Strategies That Work

1. Pay Your Credit Card Balance Each Month

For starters, you should pay off your credit card balance each month. Carrying a balance on your credit card will result in paying more interest charges on that balance. By paying your balance off each month, you can avoid the finance charges the card issuer will apply.

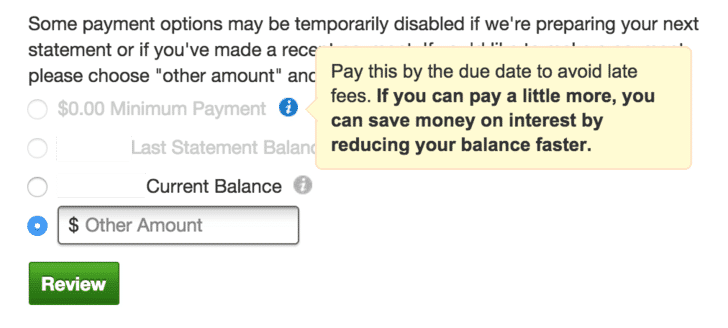

This is especially important if you have a high-interest rate. The higher the interest rate, the more you will pay in accumulated interest. Also, depending upon your balance, if you make only the minimum payment, it can take years to pay off that balance. An important thing to remember is that just because you have the ability to purchase an abundance of items with a swipe of a card does not mean you should.

Always pay your statement balance in full, every month, without exception. This is how you turn a miserable 24.99% APR card into a 0% APR card, for free and for no hassle.

2. Be Knowledgeable about Financial Terms

Some key balances that you should be knowledgeable of include:

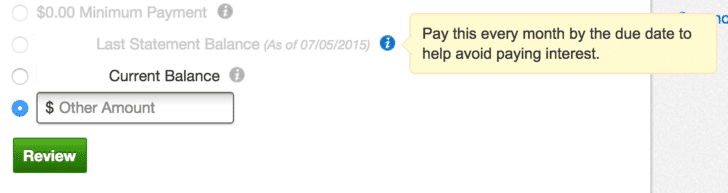

The Statement Balance is the amount you need to pay by the statement due date in order to avoid charges on interest. As you get closer to the end of the billing cycle you may notice that pending charges haven't posted to your account balance yet. Don't worry about those – the only transactions that matter as far as interest goes are the ones included in your Statement Balance.

The Minimum Balance is the amount you need to pay to avoid late payment, but paying only this amount will result in interest being charged.

The Current Balance is the amount of all the charges that have posted to your account since the beginning of the billing period and when you pay your bill. Some of the charges included in the Current Balance may be for purchases made after the previous billing cycle ended.

If you are planning on using your credit card the correct way, APR is not a concern for you since you will be paying off the balance at the end of every month. If you are not going to use it correctly, and carry a balance past your statement due date, you should seriously reconsider using a credit card for purchasing things.

3. Use Your Credit Cards Wisely

Using your credit card wisely sounds simple, yet so many people fail at it. Here's how to brush up on your credit card using skills via some examples:

Here is a good example of how to use a credit card:

- Mrs. Jane Millennial has a 22% APR credit card with a billing cycle from August 01 – September 01.

- During the month of August, she decides to purchase items costing $1000 on her VISA card. Her VISA statement for August is issued on September 02, and the statement balance of $1000 has a statement due date of October 02.

- Mrs. Jane Millennial used her card strictly for things she could afford, so she can pay the full $1000 due immediately.

- She makes the $1000 payment the day after her statement is issued, well before the statement due date. Her statement balance is $0, and she avoids interest in the Aug/Sept billing cycle.

Here is a bad example of how to use a credit card:

- Debtor Bob has a 24% APR credit card with a billing cycle from August 01 – September 01.

- During the month of August, he rings up $1000 of charges on his card. His statement for August is issued on September 02, and the statement balance of $1000 has a statement due date of October 02.

- Debtor Bob didn't use his card strictly for things he could afford, so he can only pay $500 by October 02.

- He pays the $500 he can afford on October 01. On October 02, the remaining $500 is assessed interest in the amount of (24% / 12) * $500 = $510. The unpaid $500 in addition to $10 of interest remain on his statement balance for the next billing cycle.

4. Take Advice from the Experts

According to some of debt success stories, some of the most common ways to beat debt include:

- Make more than the minimum payment.

- Pay off debt with the highest interest rate first.

- Talk to your credit card companies. See if they can help you in any way.

- Never close cards with existing balances. This will negatively affect your credit score.

- Move your debts around. Perhaps you can consolidate your debt and get a lower interest rate.

- See what you can liquidate to lower your debt.

Ready to Pay Off Your Credit Cards?

Don't fall into the habit of carrying credit card debt. It can destroy your finances very quickly and, unlike payday loans (that even those who take one out seem to realize they're a bad idea), credit card debt is not treated with the degree of caution it needs to be treated with.

In 2021, you can even pay your rent with a credit card! Although if this credit card balance is not paid off each month you might need to learn how to pay off credit debt fast.

More people should start building start financial habits and not carrying a balance is an excellent way to avoid high-interest rates. If you're interested in further improving your personal finances consider increasing your income with our post on how to make $700 fast!