Want to Make Extra Money Now?

|

Are you wondering how to make money with junk bonds? Thinking about investing in junk bonds?

Even if you are not, you could still benefit from knowing what junk bonds are. It is important to have a vast knowledge of all types of different investment vehicles. Even the riskier ones.

What Are Junk Bonds?

Junk bonds are perceived to be riskier than other types of debt, they typically trade at higher yields—that is, higher rates of return—than investment-grade bonds. Junk bonds are typically issued by a company seeking to raise capital quickly in order to finance a takeover.

Junk bonds have a credit rating of BB or lower. Companies whose bonds are rated as ‘investment grade' have a lower chance of defaulting on their debt than those rated as ‘non-investment grade'. Generally, these bonds are issued by long-established companies with strong balance sheets. Bonds rated BBB or above are known as Investment Grade Bonds.

Bond investors of all stripes are piling into junk bonds – including bond investors, stock investors, and retail investors. Bond investors are investing because they are avoiding the low yields of U.S. Treasury debt while stock investors are investing because they are seeking protection from swings in the market.

However, neither U.S. Treasury bonds nor investment-grade bonds are expected to deliver meaningful returns this year, fund managers say. So how can you profit from junk bonds?

Here are three ways to profit from junk bonds:

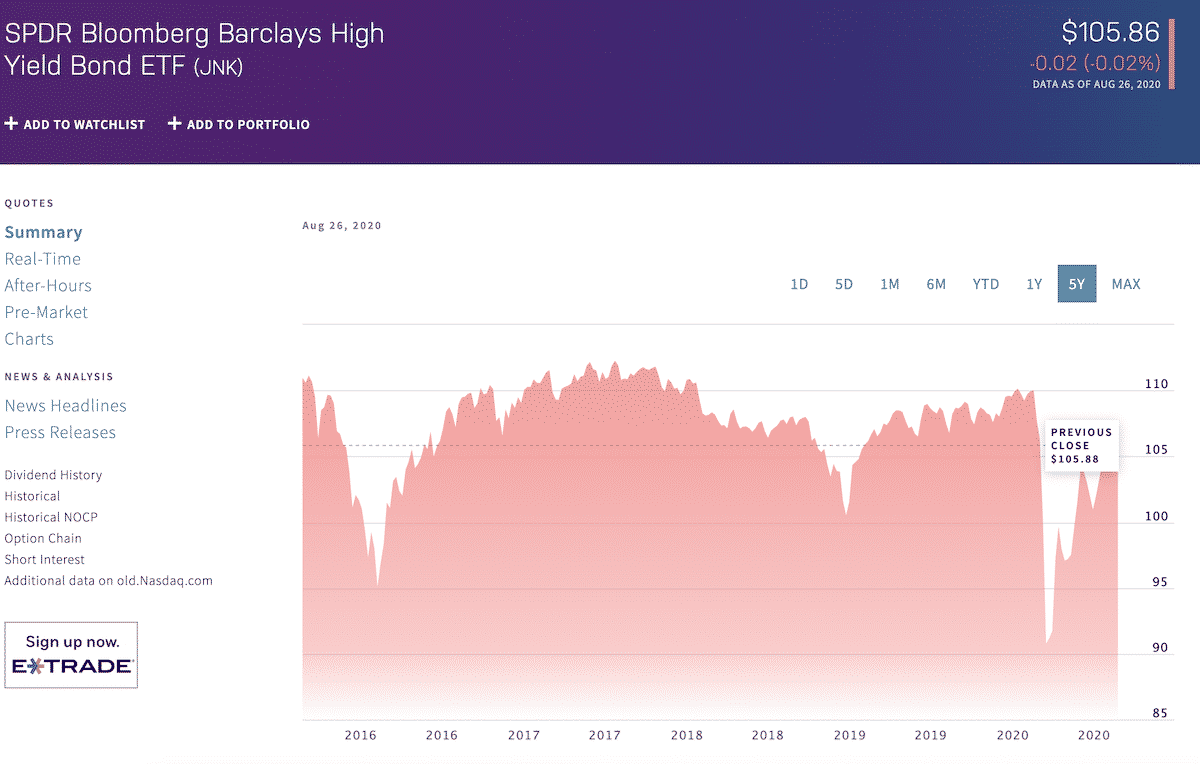

1. SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

The most popular way currently to profit from junk bonds is by investing in the JNK ETF, which has been around since 2007.

This ETF gives you access to the junk bond market and has over $9 billion of assets in is one of the largest junk bond ETFs in its segment.

According to NASDAQ, this ETF holds 967 junk bonds with 86% industrial, just under 10% finance, and only over 3% utility sector exposure, JNK's average coupon for its holdings is 6.23% with a six-year average maturity. The ETF itself is currently yielding at 6.37%.

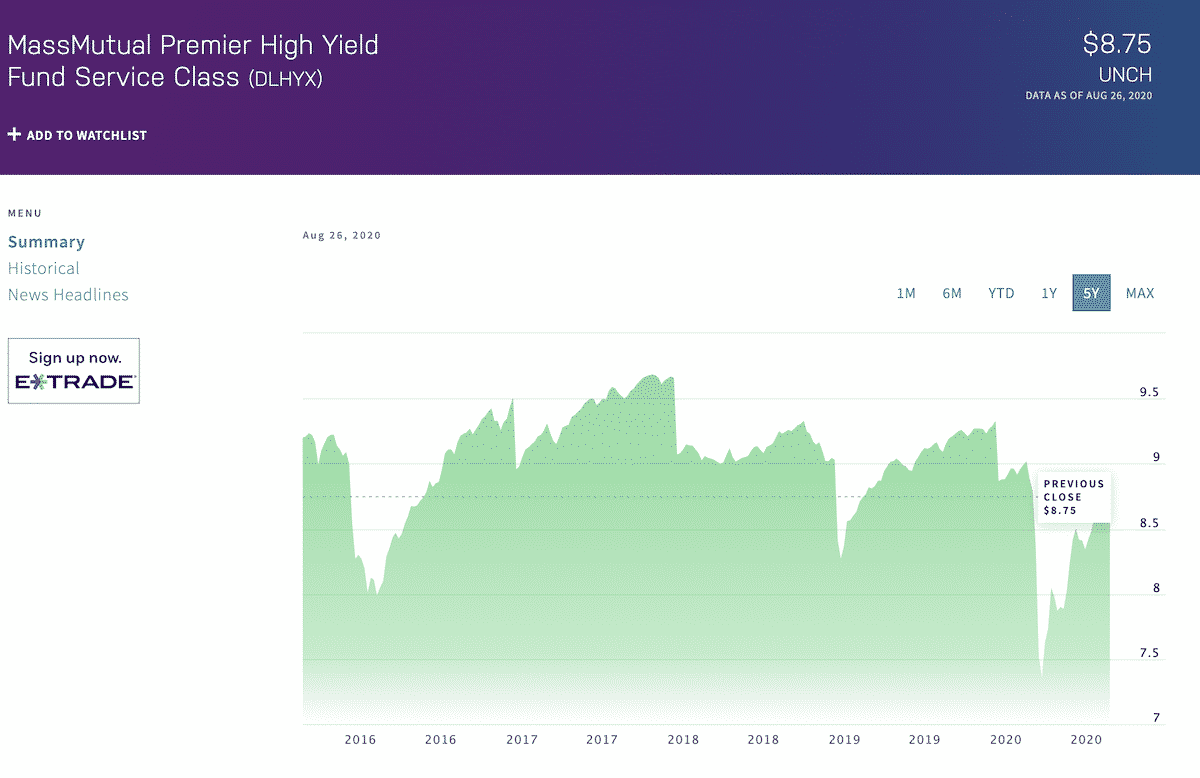

2. MassMutual Premier High Yield Fund (DLHYX)

By investing in this mutual fund you will have exposure to unrated and below-investment-grade-rated bonds. DLHYX has around 190 bonds and under $500 million in its portfolio of assets managed.

While it isn't the largest mutual fund, it has brung in steady returns of around 8% for the last 15 years. If you are an investor who wants to hold longer-term, it is an ideal investment.

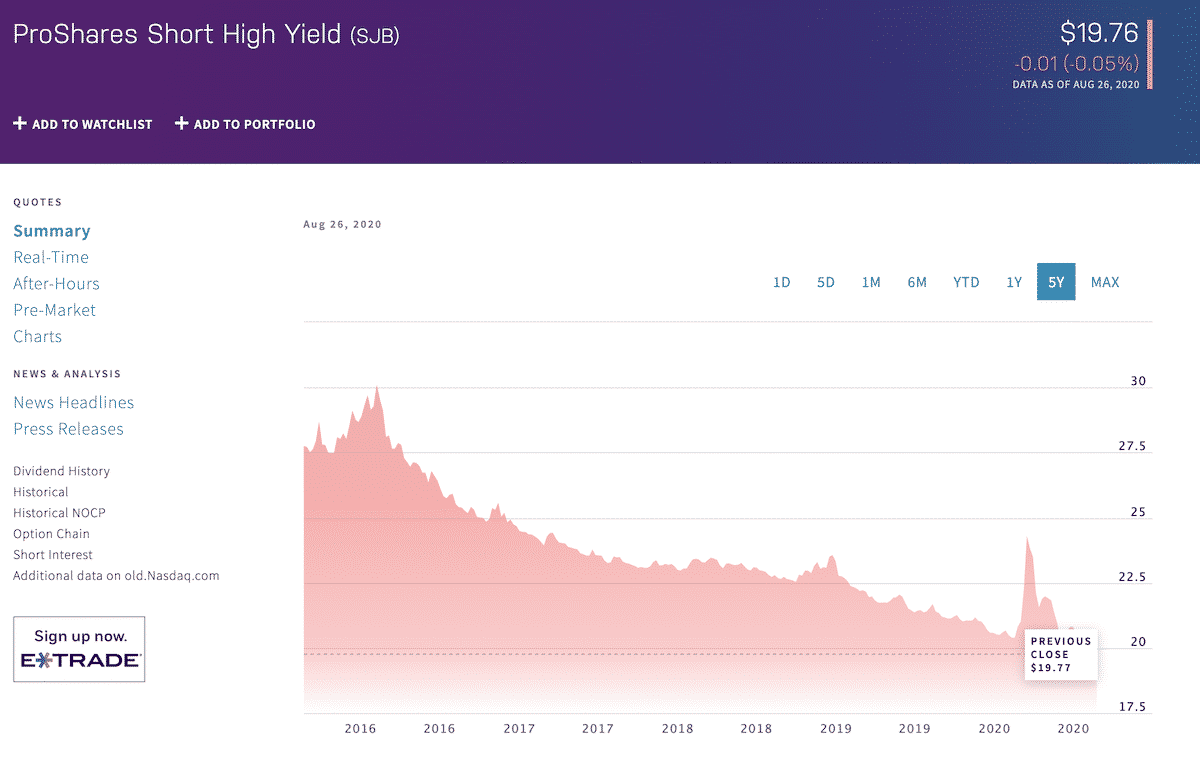

According to NASDAQ, SJB is one easy way to short the junk bond market. If you believe the crowd and are bearish on junk bonds, consider this ETF to profit from the market's downside.

Active, short-term investors may want to consider a leveraged short junk bond ETFs to increase yield. One example would be the Direxion High Yield Bear 2X Shares (HYDD).

Junk Bond Yields

The yield on junk bonds is historically between 4-6% above Treasuries. If you notice the yield spread shrinking below 4%, then it probably isn't the best time to invest in junk bonds. High-yield spreads are used by investors and market analysts to evaluate the overall credit markets.

Higher spreads indicate a higher default risk in junk bonds and can be a reflection of the overall corporate economy (and therefore credit quality) and/or a broader weakening of macroeconomic conditions. The higher current yields of junk bonds reflect their greater risk of default to the investor than investment-grade bonds or in this case U.S. Treasuries.

Too Risky?

Junk bonds occupy a middle space between stocks and investment-grade corporate bonds. They are riskier than invest-grade corporate bonds but less risky than stocks.

They may not be the right fit for most investors, but if you are a little risky then you might want to venture if this investment vehicle is the right fit for you.

Personally, your typical millennial investor would not dabble with junk bonds. They would likely have the bulk of their finances tied up in investment apps or their employer-sponsored retirement account and contributing to an IRA.

According to Goldman Sachs, $555 billion of bonds will migrate from investment-grade into high-yield over the next six months, in addition to the $149 billion that has already been downgraded year-to-date.

I personally, would suggest going this route if you haven't already. If you are looking for a safer bet check out your options below.

Want Free Stocks?

If you want to earn money beyond junk bonds, learn how you can get paid to start investing — with a bonus.

Yup, it’s true. There are several companies out there that will give you free money to invest in stocks.

1. Robinhood

Reboinhood is a free investing app for your phone. I really mean free all around – free to join and they don’t charge any fees to buy or sell the stock. You can get a share of stock like Apple, Ford, or Sprint for free when you join through this link.

The value of the free share may be anywhere between $2.50 and $1,000 and fluctuates based on market movements. You've got nothing to lose. I told you this was easy!

Download: iOS | Android | Desktop

2. Acorns

Acorns was called by CNBC “the new millennial investing strategy.” Once you connect the app to a debit or credit card, it rounds up your purchases to the nearest dollar and funnels your digital change into an investment account. Sign up to try it risk-free with a $5 sign up bonus.

Once you get the process automated, Acorns investments make your digital change work for you. I downloaded it and within a year I had $1394.25 in my account. The sooner you start investing, the sooner your money can start to grow toward your goals.

Download: iOS | Android | Desktop

The Bottom Line on Junk Bonds

Junk bonds are perceived to be riskier than other types of debt, they typically trade at higher yields though. So if you are looking to take on the risk — there are plenty of options for you to learn how to make money with Junk Bonds.

Next, you can learn how to make money fast with more proven methods (even how to make $200 fast).