Want to Make Extra Money Now?

|

What is the required credit score to buy a house? If you're stuck wondering then you should know that the minimum score required is set at 620. But the lowest credit score to buy a house with an FHA loan is 580. Read on to learn more about the credit score needed to buy a home.

Here’s how your credit score affects the home buying process.

While there's no strict credit score minimum to get a mortgage and buy a home, there are guidelines most lenders follow. While your credit score is a major factor in buying a home, it's not the only one. Lenders also consider your employment history, income, and current debts.

And, since credit scores fluctuate, following good credit practices can increase your score and help you get a mortgage or lower rate in the future.

Most first time home buyers are looking to understand how the credit process works. A good credit score can mean the difference between qualifying for a mortgage loan and having your application rejected.

It is important to understand what your credit score means, and how it is calculated. These factors directly influence your eligibility for a mortgage, in addition to your interest rate. Even if you qualify for a mortgage, a lower credit score means you'll likely be stuck with a higher interest rate. And that high-interest rate will cost you more over the lifetime of the loan.

How does your credit score factor into buying a home?

To understand how your credit score factors into home buying, you first need to understand the credit score basics. You've probably heard the phrase “FICO score” in credit card commercials, but here's what it really is. FICO (which stands for Fair Isaac Corporation) is one of the most common credit scores. It's used by banks and other financial institutions to determine your creditworthiness.

So, what makes you worthy? The bank needs to believe you'll pay back your mortgage loan, and that FICO score helps them decide whether or not you're a risk.

For them, the higher the credit score, = the lower the risk, which means that you'll enjoy lower interest rates. And, for those with lower credit scores, the opposite is true. Your credit score plays a huge role in determining whether a bank believes you a risk to pay back the mortgage loan or not. If you are deemed a lower risk (because you have a higher credit score), then you will have a lower interest rate and pay less for the loan. But if you have a lower credit score, the opposite will be true.

Factors that affect a credit report

FICO scores use several different factors from your credit report. This information comes from the three major credit bureaus (Equifax, Experian, and TransUnion), and it is used to assemble a score ranging from 300-850. Here are the factors that go into your credit score:

- New credit 10%

- Types of credit 10%

- Length of credit history 15%

- The amount owed (30%)

- Payment history (35%)

What credit score is needed to buy a house?

Your credit score plays a big role in your mortgage application, but it is important to remember that it isn’t the only factor. Financial institutions will also consider factors such as your employment history, your current debts, your income, the size of the loan you are asking for, and the total amount you are willing to offer in a down payment.

There are no hard lines when it comes to a minimum credit score. Instead of an exact answer on what is the right credit score to buy a house, most financial advisors use guidelines for home buyers. The guidelines help home buyers to determine if they are on the lower limits of an acceptable credit score or not.

Credit score guidelines

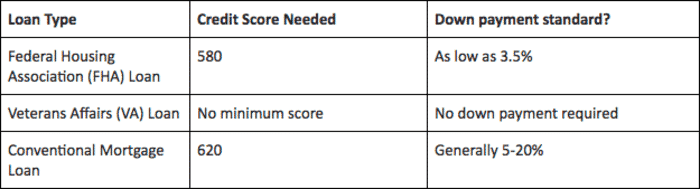

Here are a few credit score guidelines for the most common types of home loans:

When does your credit get checked in the home buying process?

When does your credit get checked in the home buying process? Well, once you send in your credit application to a lender, they are going to check your credit score. It is one of the first things they will do to determine whether you are eligible for a mortgage. If your credit score is too low for a particular lender, then they’ll use it to weed out your application before they go further and check things like your income and employment history.

Check your credit score for free by asking any of the three major credit bureaus (Experian, TransUnion, Equifax) for your credit report. Your credit report won’t just include your credit score — it will also include all of the factors that led to the final number. So you’ll be able to look and see if an account you forgot to pay, or a high credit utilization is dragging down your score. If your credit score isn’t as high as you’d like, don’t fret. You might not qualify for a mortgage right away, or you might not get the interest rate that you want right off the bat. But you can improve your credit score over time.

Types of home loans

Not all mortgages are made alike. There are several different types of home loans, and they have key differences. Here are the most common types of mortgages available on the market:

Conventional loans

This is the most typical option — two-thirds of mortgages are conventional loans. Unlike FHA and VA loans, these loans aren't backed by the government. Lenders will generally ask for a 20% down payment. If you can’t make that amount, you can pay as little as 5%. But going with a down payment under 20% means that you will have to pay for private mortgage insurance, which can be expensive. These loans typically have a 620 minimum credit score.

FHA loans

FHA loans are a are a valuable option for those with lower credit scores, as the minimum score for an FHA loan can be as low as 580. FHA loans also allow homebuyers to put down as little as 3.5%. Still, you’ll need to pay PMI if you decide to put down less than 20%, similar to a conventional loan.

VA loans

VA loans are limited to veterans and current members of the US armed forces. They are especially attractive because home buyers seeking this type of loan can put as little as 0%. In addition, there is no PMI penalty for putting down less than 20%. VA loans are backed by the federal government, and lenders are not required to use a minimum credit score.

Application process

Is there a risk in having your credit checked multiple times during the application process?

When you apply for a mortgage, the credit check is listed on your credit report as an inquiry. That means that you are looking at taking on new debt. A credit inquiry will have a small negative impact on your overall score, but there isn’t much you can do about it.

You should also know that shopping around for a mortgage isn’t going to harm your score. If you have multiple credit checks from mortgage lenders within a 45-day period, it will be reported as a single inquiry. You can shop around by completing mortgage applications, getting a preapproval, or getting an official loan estimate.

Other types of credit applications can also have a negative impact on your credit score. Applications for credit cards, car loans, student loans, personal loans, and business loans can also result in an inquiry on your credit report that lowers your score. If you are considering shopping around for a mortgage, then you want to make sure that you avoid applying for a car loan, credit card, or another type of debt so that a new inquiry doesn’t push down your credit score.

The difference between a hard and a soft check

There is a difference between the types of inquiries that get listed on your credit report. Inquiries are separated into two categories: hard and soft.

Hard inquiries occur when a lender uses your credit report to make a decision on whether or not they will provide you with credit. Credit card applications, car loan applications, and mortgage applications are all forms of hard inquiries.

Soft inquiries occur when a credit card company checks your credit to pre-approve you for a new credit card or when you check your own credit online. Soft inquiries aren’t listed on your credit report and they don’t impact your overall credit score.

How to improve your credit score

If your credit score isn’t where you want it to be, don’t get frustrated. You can improve your credit score in 3 easy steps. The first thing you should look at doing is lowering your credit card balances. Your card utilization rate plays a factor in your overall score. You’ll also want to make sure that you pay any unpaid debts as well as paying your bills on time. By paying off old accounts and keeping your new ones in good standing, your credit score will rise over time. You should also avoid taking out new lines of credit if you don’t have to. If you are making multiple applications for lines of credit, lenders will think that you are strapped for cash.

It will likely take months, at the earliest, to have a dramatic positive impact on your credit score. But following good credit practices, you can improve your score and put yourself in a position to qualify for a mortgage or get a better rate.